free cash flow yield calculator

If the free cash flow of the company is decreased and if the company is investing in its growth that is also not bad for the company. Generally you compute it using the cash flow per share and the.

Free Cash Flow Fcf In Financial Analysis Magnimetrics

FCF Net Income Non-Cash Expenses Incrase in Working Capital Capital Expenditures.

. Enter Total Cash Flow From Operating Activities into cell A3 Capital Expenditures into cell A4 and Free Cash Flow into. Rated the 1 Accounting Solution. 26 2020 into cell B2.

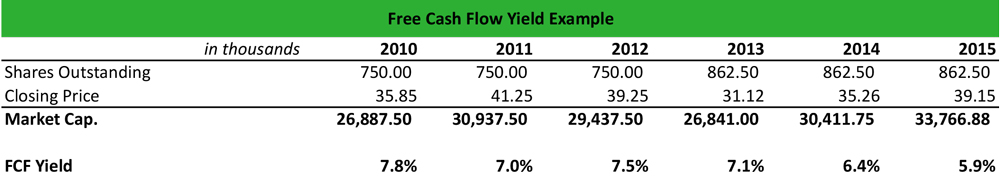

The formula for calculating free cash flow FCF per share. The Energy sector FCF rose from 168 billion in 1Q21 to 1232. The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn.

Next enter the date Sept. Cash flow yield is the percentage of cash flow a company generates based upon the price paid. Free Cash Flow 550 million 100.

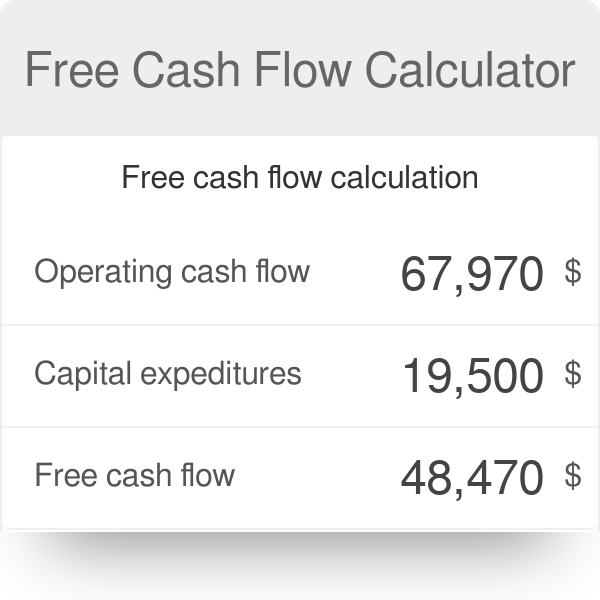

Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures. Ad QuickBooks Financial Software. To understand it we will use a hypothetical example and calculate the free cash flow for an.

Speak To An HSBC Representative To Learn More About Our Commercial Banking Services. Free Cash Flow Operating Cash Flow Capital Expenditure Net Working Capital. Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity.

Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns. Ad QuickBooks Financial Software. Our Business Consultants Will Partner With You To Build Financial and Operational Success.

Ad 93 of small business owners are constantly leaking money on useless and unnoticed things. In practical terms it would not make sense to calculate FCF all in one formula. Hence Free cash flow available to the firm for the calendar year is.

Figure 1 shows trailing FCF yield for the Energy sector rose from 07 as of 63021 to 40 as of 51622. Substituting cash flow for time period n CFn for FV interest rate for the same period i n we calculate present value for the cash flow for that one period PVn P V n C F n 1 i n n. Free Cash Flow Yield.

Free cash flow per share is a measure of a companys financial flexibility that is determined by dividing free cash flow by the total number of shares outstanding. We will see how. Rated the 1 Accounting Solution.

Get 3 cash flow strategies to stop leaking overpaying and wasting your money. HSBC Can Help You With That. Free cash flow FCF is more valuable than the net profit PAT of a company.

Ad The Key To Success Is Gaining More Control Over Cash Flows. Free Cash Flow - FCF. What is the Cash Flow Yield.

Going forward there is no way to be sure that free cash.

What Is Free Cash Flow Calculation Formula Example

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow Yield Explained

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

Price To Cash Flow Ratio P Cf Formula And Calculation

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Conversion Fcf Formula And Example Analysis

Operating Cash Flow Ocf Formula And Excel Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Calculator Free Cash Flow

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Calculation Formula Example

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)